For decades institutions have invested in the mature private credit markets of Europe and North America, benefitting from an asset class defined by attractive, defensive investment returns.

While once relatively inaccessible the opportunity for Australian investors to source the same types of opportunities domestically – to lend to quality Australasian companies – is becoming increasingly attractive.

The opening of this once guarded market is a welcome change in an environment where government bond yields continue to sit at historic lows and investors seek ways to adapt their portfolios in anticipation of an uncertain post-pandemic economic recovery.

Why invest in credit?

Credit investment – investing in a portfolio of loans between various borrowers and a non-bank lender – is proving to be a dependable source of regular income for many investors.

Credit is considered to have favourable and sustainable risk and return characteristics that make it ‘defensive’ and are different to other asset classes. Typically, any credit investment will benefit from being higher in the capital structure of a company, meaning that a credit investor is entitled to receive a return of capital before equity investors, and can call on assets of a company for repayment of outstanding amounts. In addition, the loans aren’t traded on a market, which means that value doesn’t fluctuate, and importantly income payments are contractual and capital is typically stable. These defensive characteristics of credit complement traditional allocations to equities and government-backed fixed income.

Global changes in bank regulation have historically created opportunities

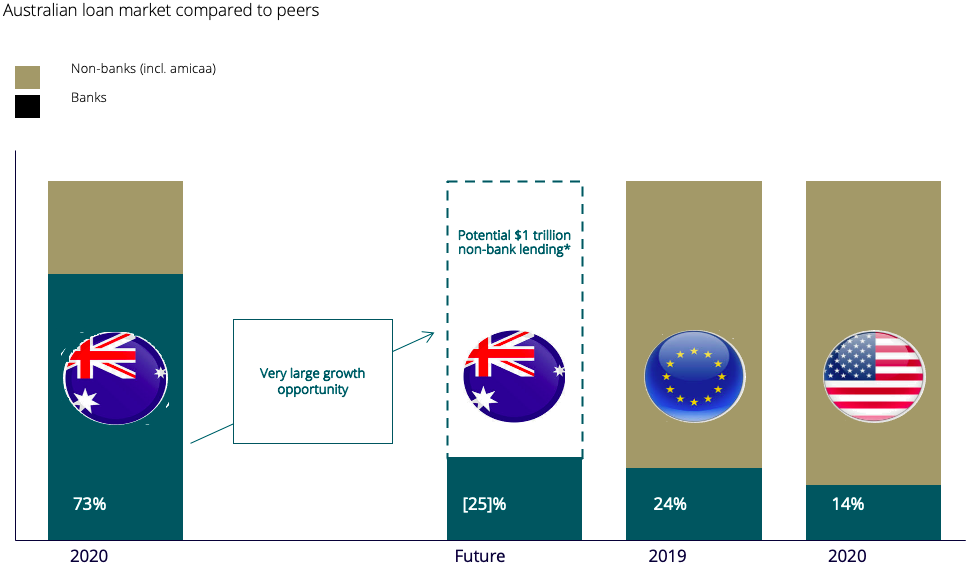

In North America the provision of debt to businesses has for many years been addressed by a range of lenders, from institutions (pension funds and insurers) to funds offered by credit investment teams, and also banks. In 2020, banks and related securities firms comprised only 14% market share of the US leveraged loan market (source: Leveraged Lending Review, Q4 2020).

Source: S&P LCD Quarterly Q4 19 Leveraged Lending Review, Q4 2020.

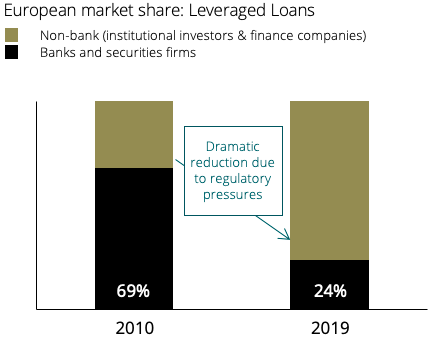

Prior to the Global Financial Crisis (GFC) the European market more closely matched the current environment in Australia and New Zealand with banks being the dominant lenders to businesses. In 2010, banks and related securities firms comprised 69% of market share of the leveraged loan market.

The GFC was a transformative event for the European banking environment. In the post-GFC environment the progressive implementation of new banking regulations, such as Basel III, created very strong incentives for banks to reconsider their business models. This resulted in European banks withdrawing capital from several parts of the market, and saw their market share of corporate lending progressively decline from 69% to 24% from 2010 to 2019.

Australian & NZ market – ripe for change

Like Europe before the GFC, the provision of credit in Australia and New Zealand has historically been very bank focussed. Our market currently represents $1 trillion in business lending, and is dominated by the four large domestic banks.

Due to a range of factors, the Australian and New Zealand banking sector emerged from the GFC in much more robust health than most regions. This meant the early adoption of Basel III by APRA initially had limited impact on the domestic banking business models in Australia and New Zealand. However, we believe the current environment is already seeing change.

The Australasian credit opportunity

More recently there have been a number of changes for banks brought about by the adverse findings of the royal commission into misconduct in the financial services industry (“Hayne Review”) and the potential adoption of Basel IV. As revelations of misconduct came to light and capital reforms implemented, so too commenced transformative change in the provision of credit to Australian business, similar to that witnessed in Europe over the past decade.

This market evolution has in turn created a scarcity of bank capital for lending to businesses in Australia and NZ, further affected by the recent COVID-19 pandemic.

These conditions have led to deal structures and terms are typically superior for lenders and credit fund investors, for example:

- lower leverage to operating cashflow – reducing the credit risk on loan investments,

- credit enhancement – increased equity contribution in new loans,

- favourable terms – the inclusion of more lender-friendly security packages, covenants, and other lender protections and

- higher pricing – opportunity to receive a higher running yield on capital invested.

amicaa believes that in most cases, the superior risk-adjusted returns available reflect the premium required to attract liquidity to this transforming asset class rather than any change in fundamental risks.

amicaa estimates that evolution similar to that witnessed in the European markets represents a potentially $1 trillion+ opportunity for non-bank lenders in Australia over the next 10 years.

Source: APRA Quarterly ADI Performance, * amicaa estimates, S&P LCD Quarterly Q4-19 Leveraged Lending Review.

Source: APRA Quarterly ADI Performance, * amicaa estimates, S&P LCD Quarterly Q4-19 Leveraged Lending Review.

The market is now accessible

The current environment is creating an emerging opportunity to invest in a large, mature and well-established asset class – Australian and NZ corporate credit – that has not historically been accessible to most investors.

The market disruption currently underway presents a new, large and persistent opportunity that will allow experienced credit investment managers such as amicaa to deliver investment opportunities with attractive risk adjusted returns for investors.

For more information on Australian corporate credit investments, please contact amicaa on 1300 896 514, by email at [email protected] or visit www.amicaa.co.

Source: APRA Quarterly ADI Performance, * amicaa estimates, S&P LCD Quarterly Q4-19 Leveraged Lending Review.

Source: APRA Quarterly ADI Performance, * amicaa estimates, S&P LCD Quarterly Q4-19 Leveraged Lending Review.